Taxes and solar companies

- PILOT (Payment in Lieu of Taxes) The Cortland County Legislature was debating to give the Commercial Solar Systems a PILOT (Payment in Lieu of Taxes) to reduce their costs and add more solar to Cortland County. Could this generate more revenue for large corporations? Learn more here

- Clawback tax agreement: Tuscola County is facing down a financial abyss thanks to the state’s largest energy provider, which is attempting to claw back nearly $1.2 million in disputed tax revenues levied,.....Consumers are suing numerous taxing entities in Tuscola County as part of a wider effort to win back $8.5 million in taxes paid “It’s really hard to stomach this when we know their profit margins are in the billions,” Pierce said. “In our world, it’s a classic bait-and-switch.” …“No one thought it was going to come to this,” said Hahn. “People wouldn’t have agreed to having wind farms if they knew this was going to happen.” “We’ve seen that pushback from local townships that are being approached with solar installations,” Osentoski said. “They’re pretty much point blank when we talk to them, saying, ‘unless we get the wind tax issue resolved, don’t expect us to do anything with solar.’” Learn more here

- ITEP tax program "Our parish will miss out on an annual tax revenue of approximately $5.6 million dollars every year...this is money that could be spent on fixing and upgrading parish roads, maintaining and building new schools, paying our teachers a better salary and becoming more competitive in attracting teachers"....Learn more here

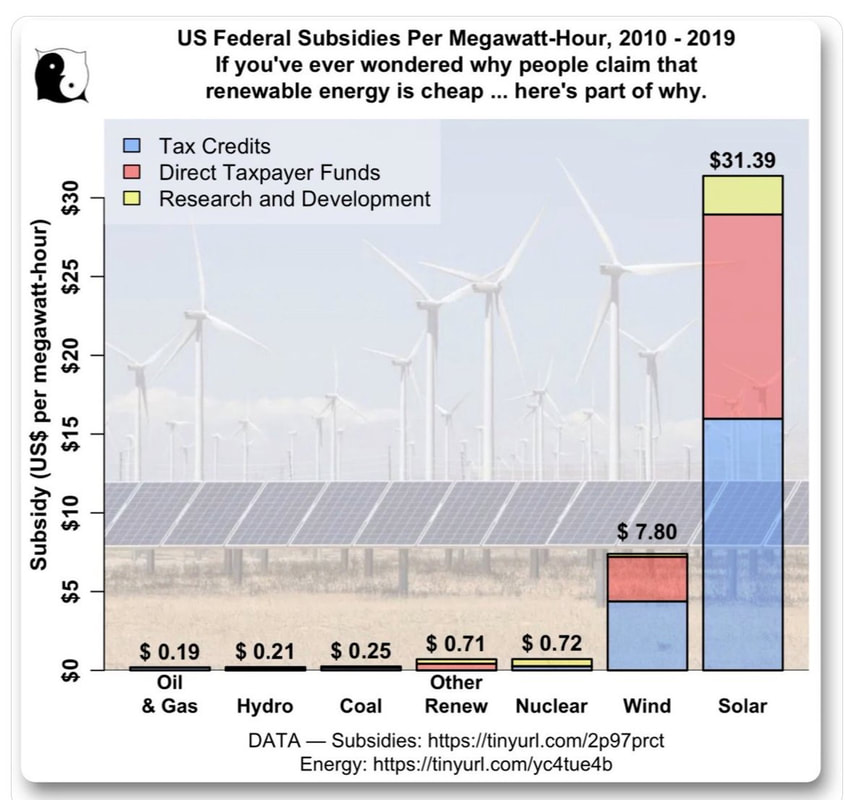

- Investment Tax Credit (ITC) The solar industry celebrated when the Investment Tax Credit (ITC) was extended at 30% for the next decade. Its lesser-known counterpart, the Production Tax Credit (PTC) was also implemented with the passage of the Inflation Reduction Act (IRA) of 2022. Learn more here

- Chapter 312 and 313 tax abatement- Learn more here

Something to think about

- If the agricultural land isn't re-zoned back to agriculture, could the owner now put in a business or sell the land to have business move next door?

U.S. Federal solar subsides

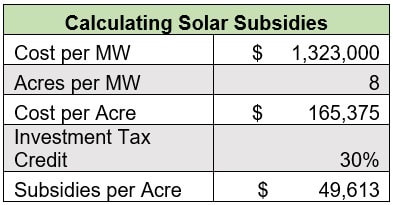

Doing the math on solar subsides per acre. Almost $50,000 per acre and only around $1000 to lease the land. Learn more here

Money for solar comes from:

The information contained on the MoreAboutSolar website does not, and is not intended to, constituted legal advice; instead, all information, content and materials available on this site are for general informational and educational purposes only. The decision to use content on the MoreAboutSolar website is the responsibility of the reader. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser. While MoreAboutSolar believes the information on its website is accurate, we encourage the reader to conduct their own research, as much information is subject to interpretation, and information may be updated, as new research, findings, materials, reports and studies become publicly available.